Scammer red flags: what to look for

By Auntie Scam

In the early days of the internet I chatted with all kinds of people online. I shared personal info with strangers and I didn’t worry.

Online spaces were nerdish, authentic and arty. Performative behaviour wasn’t incentivized. There was no online banking. If you wanted to buy something on eBay, you sent cash in the mail — and, in most cases, you actually received your item!

Fast forward to 2025 and scammers are everywhere. As a result, my new default mode when online is “detached suspicion.” It’s not my favourite persona, but I’m here to survive.

These days, I only chat with online strangers in a few, very specific situations, such as heavily-policed Facebook groups (because where else can a collector meet the world’s leading experts on ancient beads + Georgian jewelry?!).

The rest of the time, I assume that anyone I talk to exclusively online, via email or text, on social media, or on the phone — especially if they initiate contact — is a criminal. Not because I believe this is actually true, but because making a blanket policy and following it is the easiest way to protect myself. It’s just too mentally exhausting to devote the time required to figure out who is safe and who isn’t.

Scam patterns

When you spend your days obsessively researching the horrors of the modern internet, clear patterns emerge. So I wanted to make a list for you.

Here are some warning signs that can help you spot a scammer before they steal your life savings, your mental stability, or both.

RED FLAG: Pressure to act now

Scammers want you to do things right away.

A scammer might say your bank account has been compromised, you’re about to lose a prize, you’re in trouble with the law, or a person you care about is in danger.

Scammers don’t want to calmly explain all the details about what’s supposedly happening. They want you to panic and take action.

A scammer may keep you on the phone for hours, convincing you that something terrible will happen if you hang up. That’s because scammers lose when you have the time to apply logic to what they’re saying.

For example, a scammer might stay on the phone with you while you drive to your bank and withdraw cash, then instruct you to drive to a specific crypto machine and make a deposit. This sounds so outrageous you might think it could never happen to you. But in the moment, everything the scammer says makes sense. It’s like they’ve kidnapped your mind.

Scammers are professional liars. None of us are immune.

If someone you’re talking to is pressuring you to: 1) send money, 2) share your account numbers or passwords, 3) share personal info such as your date of birth or Social Security number, 4) read back or type a code you receive via a phone call, text or email, 5) download software from the app store or a website, 6) log in to your account on a website you’ve accessed via a link or QR code, 7) open a text-only window on your computer that looks like code and type something you don’t understand, or 8) accept a payment or a package — you’re in the red flag zone.

If you call someone — your bank, for example — and you know for sure that you’ve dialled the right number (found using the back of your bank card, a business card, the official app, or on the official website typed directly into your browser), it’s okay to provide account info and answer security questions.

But if someone calls you (or contacts you via text, email or social media) and asks for any of the above, they are a scammer.

The best way to protect yourself is to stop communicating (hang up the phone, shut down your computer) and call a loved one for advice. The longer you stay engaged, the more likely you are to become ensnared in a scammer’s trap.

Information Overload

I know this feels like an overwhelming amount of information. But don’t worry, we’re going to slow down and thoroughly explore these scenarios in detail in future articles. This is just a quick overview.

You don’t have to memorize anything, just skim through. What seems like a bunch of complicated rules right now will eventually start to feel second nature. As your brain figures out the big picture, patterns will emerge. It will all make sense at some point, I promise you.

RED FLAG: Gift card requests

Scammers want gift cards.

That’s because gift cards are almost as good as cash, are virtually untraceable, and do not trigger fraud detection systems. Once a scammer has the gift card number and PIN, they can quickly spend the money. And once it’s gone, it’s probably gone forever. The chance of getting your cash back or figuring out the real identity of the person you sent it to is low. Even if you can prove it’s a scam.

It’s okay to give gift cards to friends and family. But if someone you’ve never met in real life asks you for gift cards, this person is 100% for sure a scammer. A gift card scammer will make up all kinds of plausible reasons they need you to buy them cards.

These reasons are lies.

That’s why I tell my friends: If you’re chatting with someone online who asks for a gift card, you need to flip a mental switch. Your former “kind and charismatic internet friend” is now “dead to you.” Even if you feel like you’re falling in love. Especially if you feel like you’re falling in love.

But what if it’s an unusual situation, you ask? What if the person you’re talking to has been in a terrible accident overseas while volunteering to help injured children, and the evil local government has frozen their bank accounts? Or what if they’ve been kidnapped by a blue and yellow monster in the basement of Best Buy — a monster who transacts exclusively in $500 Apple gift cards?

Whatever fantastical reasons your scammer comes up with, you can safely ignore the details. Because this person is now dead to you. You need to block them on your phone and social media (without saying goodbye or explaining why) and never talk to them again. Sad, but essential. (Actually, not that sad — because this person was trying to scam you.)

Why I Tell My Friends to Cut Contact

When a person you’ve never met in real life asks for gift cards, they are testing you.

Here’s what a gift card request really means:

“I am working out of a scam call center in a developing country (or I’m an inmate at an American prison) and I’m testing you right now to see if you know gift card requests only come from criminals.

If you hesitate for a millisecond or sound even slightly unsure before saying no, I’m going to keep trying to convince you. I will not stop until you hang up or block me. If you end up rejecting my gift card grift, I will change my request to crypto, wire transfer or sending cash.

If you say ‘maybe’ or ‘yes’ to any of these options, I’m devoting myself to you for up to a year — and I’m coming for every dollar in your bank and retirement accounts. I will find out what’s missing in your life and I will fill that void — in exchange for cash.

I’ll be charming and maybe even flirtatious. I’ll text you multiple times a day. I will not stop talking to you until you are homeless. When you’re homeless, I’ll say goodbye and discard you without explaining why as you’ll be worthless to me. The scam call center will give me a promotion. And I’ll celebrate your destruction. Your loss is my gain.”

RED FLAG: You are told to keep secrets

Scammers don’t want you to tell your friends and family what’s going on.

The more info you share with your loved ones, the more likely it is that someone will say hey, wait a minute and identify the scammer as a criminal. That’s why scammers manipulate you psychologically — to isolate you from the people most likely to help.

Scammers use many of the same tactics as abusive romantic partners. Like an abusive spouse, their end goal is to control you. They take advantage of your protective instincts, your trust, and your kindness. They pretend to be on your side. But scammers don’t care about you — they just want you to open your wallet.

Scammers tell plausible lies

A scammer might say:

“The employees at your bank are under investigation for fraud. I work for the FBI and we are conducting a sting operation that requires complete secrecy. You need to withdraw all your cash to protect it. And don’t tell anyone. If the bank teller asks why you’re withdrawing all your money, make something up. Your lie will help the FBI take down a transnational criminal organization.”

If you think you are too smart to fall for this, think again. This scam has bankrupted countless intelligent people. Here is one example:

Your loved ones will appreciate you checking in

As awkward or embarrassing as it might feel, if you think you might be involved with a scammer, it’s important to share what’s happening with people you trust. And try to be open to their assessment of the situation, as hard as it may be.

Remember: Scammers are professional manipulators. If there was a school for this, they’d have PhDs in psychopathic control. When you have daily conversations with a scammer who’s playing the long game, they can change your view of reality. And — surprise, surprise — the new version of reality they are molding for you only benefits them.

RED FLAG: A bank or government agency asks you to move money

Scammers try to trick you by impersonating trusted organizations.

You receive a call, an email, a text, or even a letter claiming to be from a financial institution’s fraud department or a government agency. The person who contacts you seems legitimate. They say that your bank account has been flagged due to fraudulent activity, or that there’s a problem with your taxes, your Social Security, or your immigration status. Then they ask you to transfer money or pay a fee to fix the situation.

But the truth is they just want to scam you.

Scammers may sound official, but real employees of banks and government agencies don’t ask for payments in crypto or gift cards. They don’t send threatening texts. And they don’t ask you to keep secrets.

Most importantly, your bank will never call you and ask for access codes or personal information. If your bank needs to get in touch with you, they will ask you to call them back using the number on the back of your bank card. This is for your protection. Calling back is the only way you can be sure that you’re really talking to them.

(Note: This is confusing because, in the recent past, legitimate bank fraud departments did call customers and ask for access codes and personal information over the phone. I’ve heard that some smaller credit unions still do this now. If you feel overwhelmed trying to keep up with all the new “rules” that somehow you’re supposed to automatically know, trust me, you’re not alone.)

Law enforcement, government agencies and financial institutions are obsessively focussed on shutting down scammers, but it’s not easy. Scammers are always one step ahead. When a tactic stops working, like rats, criminals will find a new way in.

You can’t trust caller ID or email sender names

If your bank’s info appears on your call display, this doesn’t mean it’s really your bank calling you. Call display names and phone numbers are easy to fake. And email addresses can also appear (superficially at least) to come from a person or organization who is not really the sender.

The safest way

Because so many scams start with a phone call, an email, or a text, it’s best to assume that all incoming calls, emails and texts from government agencies, law enforcement, financial institutions, businesses (including those you have a relationship with) and people you don’t know, including wrong numbers, are from scammers.

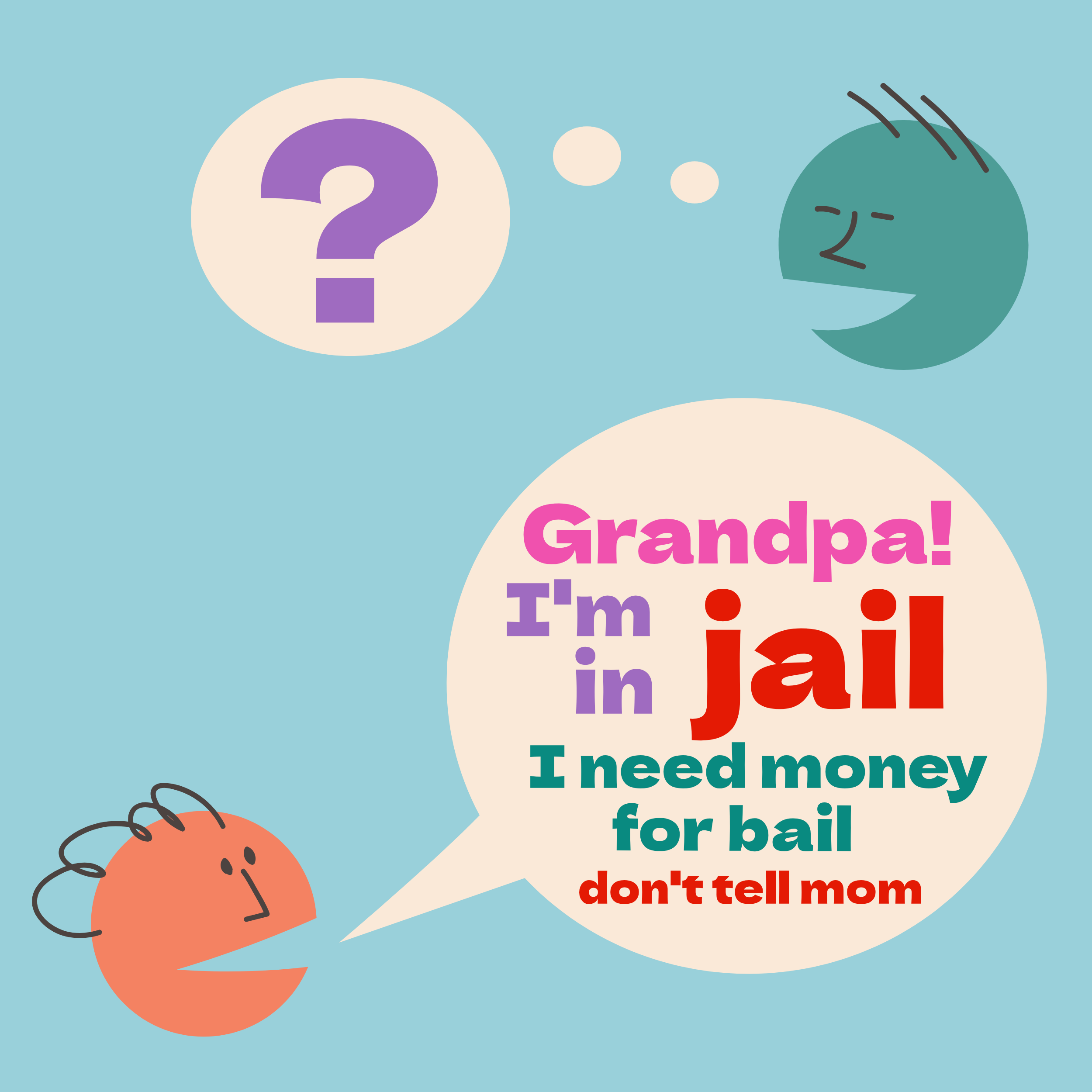

RED FLAG: A family member calls with an emergency request for cash

Scammers pretend to be people you love.

You might have heard of the “grandparent scam.” Someone calls, pretends to be your grandchild or other family member, and claims that your loved one has been arrested or is in danger and need money fast.

It may even look like the call is coming from your family member’s phone.

With AI tools and a bit of online research, scammers can now generate fake photos, realistic audio clips and videos of your family members (or even pets) to make the supposed danger seem more real.

As terrifying as these calls feel, they are always scams. The best approach is to hang up immediately and call your loved one to confirm that they’re safe.

RED FLAG: An online romance becomes financial

Scammers fake falling in love with you.

Scammers may initiate contact through dating sites, social media, or via an “accidental” text, and pretend to have a romantic interest in you.

Over time, they build emotional trust. They may say they love you and might even ask you to marry them. The romance may feel so strong it starts to take on features of an addiction.

Because you’re in a “relationship,” it seems more natural to be asked for financial help to cover emergencies, visas, travel or medical bills.

The fact that you’ve never met in real life might feel like a mere technicality. But it’s a huge red flag.

RED FLAG: A technical support rep needs access to your computer

Scammers pretend to help you fix your computer.

This is how the scam starts: a pop-up window fills your screen warning that your computer has been infected by a virus. The warning includes a number you can call for “help.” Or maybe a “technical support rep” calls you out of the blue, claiming that your computer has been hacked.

Once you start talking to the person you think is helping you, they ask you to install software. But they may not be clear about what they’re doing. They might say, “I’m connecting you to our secure server” or "I’m sending you a link, you just have to log in to secure your account.”

This gives them remote access to your computer. (Which is really bad.)

They might pretend to fix a problem that doesn’t exist, then demand payment. Even worse, they might install an infostealer to get access to your passwords and personal information.

A few suggestions:

1) If a pop-up “virus alert” window fills your screen and you can’t figure out how to get rid of it, shut your computer down and restart it. (If your browser asks if you want to restore your previous session, say no.) Think of the pop-up alert as an annoying ad, not an authentic warning. As long as you don’t click any links or call the advertised tech support number, you should be fine.

2) If someone calls unexpectedly to fix a problem with your computer, assume this person is a scammer. In these scenarios, it’s best to hang up without saying anything. (Interacting with scam calls leads to more scam calls.) As rude as it might feel, you don’t owe the scammer any kind of response — even a no thank you.

3) If you can figure out how to do it, check to make sure pop-ups are blocked in your browser. Installing an adblocker is also a good idea. (If this sounds like a bunch of gibberish, your tech-savvy loved ones might be able to help. It may also be worth signing up for an annual tech support subscription service like Best Buy’s Geek Squad.)

4) If you’re worried that you have a virus, take your computer or device to a repair technician at Apple, Best Buy or to a smaller shop you know you can trust. It’s risky to search for tech support online or call customer support numbers you find via Google. That’s because some Google search results (especially “sponsored” results) link to scam websites run by criminals who have only one goal: to steal your money. To find an authentic tech support number, it’s best to type a known website address directly into your browser — for example, apple.com — then call the support phone number listed on the website.

RED FLAG: An online friend refuses to meet

Scammers say they want to meet you.

Though they might say they can’t wait to meet you, scammers don’t actually want to see you in real life. The illusion they’ve created only works if you don’t know who they really are. A scammer designs their so-called life so you will believe their excuses. They are working or volunteering abroad, they are travelling, they are busy with family obligations on the other side of the country. You get it: blah blah blah.

They may set up a real life rendezvous, but something always comes up at the last minute and it doesn’t happen. Scammers are the Mr. Snuffleupaguses of the online world. They are full of excuses: a close friend is in the hospital with a sudden illness, a family member died, or maybe on the way to the airport they were in a terrible car accident that involved casts and traction. Of course they were — it’s because they were so excited to see you, distracted. It all makes sense, in a way.

It’s dramatic, romantic, like something out of a movie — but it’s your life.

Unfortunately, that movie is less like Titanic and more like The Talented Mr. Ripley.

So who is that attractive 35-year-old Asian-American businesswoman you’ve been chatting with about philosophy and crypto (or the 48-year-old retired military physician who is now volunteering in a war zone)? This is a fantasy persona, a fake human, designed with the help of market research, just like any other product. It’s custom-made to give you exactly what you want.

Statistically speaking, the real person on the other side of a romance scammer’s screen is most likely to be a 20-something dude, calling you from Africa or Asia.

That’s why they don’t want to meet you.

Even worse, the person you’re talking to might be a victim themselves — one of the hundreds of thousands of young people who applied for seemingly legitimate jobs and instead were trafficked into scam centers in Southeast Asia. So you might be chatting with a prisoner, who spends 16-hour days scamming against their will (literally at gunpoint).

But what about all the photos and videos they sent you?

The images are stolen from social media profiles on Facebook or Instagram, or generated with AI. You might be able to track the origin of stolen photos using a reverse image search tool. But if they were made with AI, you’ll never find them. As real as they may seem, these so-called “people” never existed. So if you haven’t met an online companion in real life, it’s smart to be suspicious — especially if they ask you for money.

Some of the more sophisticated scam operations use photos of real models who also participate in occasional video calls. These models are employees of the scam operation who chat on camera with many different victims to provide “proof.” The rest of the time, victims are texting with a different employee (or employees) who pretends to be the woman.

Coming soon to a cellphone near you: realistic live AI video chats

Warning: Some scammers are now using AI to layer a fake image over their faces and bodies while video chatting with you. So, for example, a 20-year-old man from India might use AI to appear on video as a middle-aged white dude.

Scammers are also experimenting with fake AI video avatars they control in real time from the sidelines. Imagine a scenario where a male scammer pretends to be a woman (which is extremely common). He’s texting you daily, he’s sending you fake photos and videos of the attractive woman he’s pretending to be. But you know these things can be stolen or created with AI — so you ask to do a live video chat as proof.

No problem! the scammer will say in the very near future.

As long as he has access to the latest technology, even a low-effort scammer will be able to video chat as a fake person. He’ll just have to take the images he’s been sending you and feed them into an AI video avatar creation tool. And, voila, a realistic video manifestation of your online girlfriend is born.

Lets’s say you ask to do a video chat as proof. The scammer agrees and calls you a few hours later. You answer and there “she” is — your online girlfriend, in the flesh, so to speak — right there on your cellphone screen.

She waves. You say hello.

She says your name, followed by, It’s so nice to finally meet you!

And there you have it: proof.

As sci-fi as this all sounds, it’s very close to existing. Today’s real-time video chat avatars are still a bit too glitchy to be convincing, but they’re improving rapidly.

Proceed with caution

Based on what I see now, I think it’s best to assume that all photos and pre-recorded videos sent to you by someone you haven’t met in real life are fake.

If the person you’re talking to is local, try to set up a meeting as soon as possible. If they live elsewhere and can’t meet up, be cautious.

What about video chats?

If someone you suspect is a scammer agrees to do a live video chat, there are three possibilities:

1) the person is really who they say they are (low probability), they will ask you for money, and you are one of many they are pursuing

2) the person in the video chat is real, but is an actor and is not the person you’ve been texting with (for example, one actor/model at an Asian scam center will do video chats with many different victims)

3) if the room is dark and the video chat is short, you might be talking to a scammer who is using AI technology to turn into a different person

Live AI avatars are getting better

The tech is not quite there yet. But eventually, real-time AI avatars will be convincing enough to fool people.

How it works: As we discussed, in the very near future, a scammer will be able to create an AI-generated “video human” with just one photo. To make your fake friend seem even more realistic, the scammer can input your text chat history, so the AI knows everything about your “relationship.” The video avatar can also be trained to have a consistent voice, personality and backstory. If the scammer doesn’t speak your language, the AI avatar can translate.

This fake human will be able to video chat on its own without assistance. But if the scammer prefers, he can control what the avatar says via typing or speaking. There will be a slight delay, but he can attribute the lag to the fact that he’s calling from a remote location.

(I’m not sure if there’s a better use for the word, dystopian.)

If you’re curious to see how far the technology has advanced, check out the first few minutes of this video shared by Chinese AI researchers in December 2025. The video shows “audio-driven AI avatars” simulating a conversation in real time. The video quality is high, and unlike previous models, it can stream infinitely. (The audio input originates from a different source in this case. So the best way to describe it is: “two puppets animated by words,” if that makes sense.)

As you can see, there’s an uncanny valley effect, the lip movements are off, and the AI voices sound unnatural. Also, the technology is currently prohibitively expensive. But this will change. So I hope you’ll be prepared for fake video people appearing on your screen at some point in the very near future.

What’s possible right now (as of December 2025):

Face swapping

This is a tutorial of a man layering an image of a woman over his face (also known as “face swapping”) from late 2024. If you’re interested in seeing how this AI-assisted tool works, it’s worth watching the first two minutes.

Face + body swapping

This more recent example is from an app that allows a user to chat on FaceTime with a photo layered over their face and body. It also changes their voice, allowing the user to pretend to be a completely different person. The app was released to the public in September 2025. Anyone who video chats with you could be using an app like this.

Real-time AI avatars

This video shows how a real-time AI avatar puppet can be controlled from the sidelines:

As you can see, real-time AI avatars are weird.

Pre-recorded AI videos

However, pre-recorded AI videos are now so realistic that many people may not realize they’re looking at a fake.

In fact, a scammer with a bit of tech knowledge can easily generate a short video of your “online friend” that matches the stolen or AI-generated photos they’re using to trick you.

So if someone you’re talking to sends you a pre-recorded video, this is not proof. The person in the video might say your name and allude to details you’ve shared — but this means nothing. The scammer can write all the dialogue in the video so it’s customized just for you.

Yes, we are living in the future.

I realize how disturbing this all is. But it’s important to understand what’s possible so we can protect ourselves.

Here’s a recent example of a pre-recorded, 100% AI-generated person in a video. It’s hard to believe that “Michelle” only exists on a server in Iowa.

I know how devastating it is to be tricked by fake visuals. It’s so much easier to believe the fantasy and keep chatting with your companion. Even if there are red flags, you don’t want to risk shattering the romance, just in case it’s real. But I hope you will find the courage to be suspicious.

Scammers who engage in these tactics are criminals who don’t care about you. They just want your money (or to use you to move money from other victims). It’s better to be skeptical and heartbroken than homeless, that’s my philosophy.

RED FLAG: An online friend wants to teach you to invest using crypto

Scammers love crypto.

They love it so much that I think you should set your brain to auto-translate the word “crypto” into the word “scam.”

So if someone tells you to go to a crypto machine, they are actually telling you to go to a scam machine. If they tell you to invest in crypto, they are telling you to invest in a scam.

This one action will save you so much time (and money).

(Yes, there are legitimate ways to buy crypto and not everyone who invests in crypto is getting scammed. But unless you already understand crypto, it’s best to abstain — especially if you are not tech-savvy. Crypto is complicated, crime-adjacent, and can be easily stolen. In my opinion, there’s just too much risk.)

Here’s how crypto investment scams work:

Someone contacts you on social media or via an “accidental” wrong number text and strikes up a casual friendship. This person is often the opposite gender, is younger than you and attractive, and sometimes (but not always) presents as a person you could imagine having a romantic relationship with at some point in the future. In non-romantic scenarios, this person has (what in retrospect will seem like a suspicious number of) shared interests.

You chat frequently. Your conversations are fun and genuinely interesting. At some point, your new friend may share that they work in finance are knowledgable about investing, or have a close relative who invests in crypto. But money is not the main topic of discussion.

This person gains your trust over a period of weeks, months (or possibly even up to a year), while you continue to bond over shared interests. You may be in a romantic relationship by this point (the fact that you’ve never met in person seems less important than it normally would as the reasons feel plausible).

Then, one day your new friend casually brings up how much money they’ve made investing with crypto. They might send you screenshots of investment balances and impressive charts. It feels natural when they ask you if you want to learn how to do it too.

They might say: We’re so close now, I feel guilty that you’re missing out.

Once they convince you to try, they’ll show you how to buy crypto using a legitimate platform such as Coinbase. They might say, let’s start with a small amount you’re comfortable with. Maybe it’s just a few hundred dollars. They are always are so kind.

Once you own crypto, they become the consummate teacher. They explain that their investment method only works on a special site. They show you how to create an account on this site, then help you transfer your crypto and make your first investment. When you log in to your account, your gains are impressive. The line always seems to go up.

A few weeks pass and you’ve made quite a bit of money. But is it real? Your friend encourages you to log in and cash some out. You withdraw some crypto, convert it back into your local currency, and deposit it into your bank account. It works — the money is real!

Your friend convinces you to invest more. How could you say no? And more. Until you’ve invested every penny you have. At some point you get nervous and try to withdraw some of your gains. But it doesn’t work this time. The site seems to be frozen. You can see the crypto in your account, but you can’t access it.

Your friend says there’s a technical issue. They tell you they’ll check with their contact at the company. When they get back to you, they say that your account is frozen due to fraud, (or taxes you owe, or some other semi-plausible reason).

The only way to regain access, they say, is to deposit more crypto as a payment. But no matter how much money you put in, your friend keeps asking for more to unfreeze your account. You’re incentivized to continue because you can see the millions in your account waiting to be moved. Your thought process: If I can just find a way to get back in, I’ll transfer everything out and I’ll be fine.

You friend continues to manipulate you, pressuring you into draining what remains of your savings and retirement accounts, borrowing from family and friends, even mortgaging your house — until you have nothing left.

Then your friend blocks you and you never hear from them again.

In the aftermath, you learn the terrible truth. Your gains were never real — because you didn’t actually invest. Your “friend” controlled the numbers and charts on the scam investment site. And your crypto went straight into their wallet. Everything you gave them is long gone. You can (and should) report it to the FBI and your local authorities, but the chance of getting your money back is close to zero.

Follow me for scam alerts

If you’re interested in updates on all the latest scams to watch out for, follow me on Instagram or Facebook.

Thanks for spending your precious time with me.

Love Auntie Scam